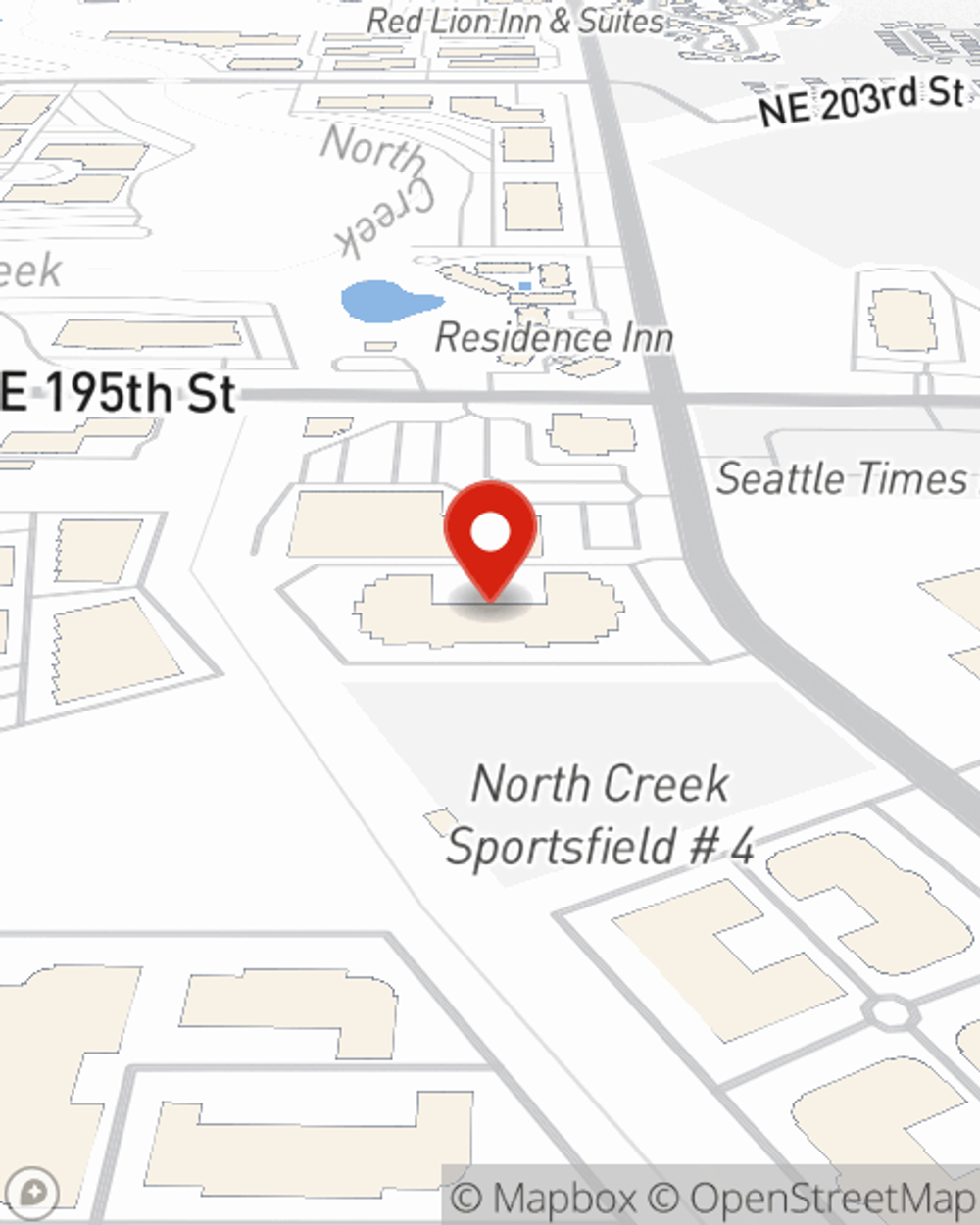

Business Insurance in and around Bothell

Searching for protection for your business? Look no further than State Farm agent Joel Hensel!

This small business insurance is not risky

This Coverage Is Worth It.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like extra liability coverage, business continuity plans and a surety or fidelity bond, you can feel secure knowing that your small business is properly protected.

Searching for protection for your business? Look no further than State Farm agent Joel Hensel!

This small business insurance is not risky

Small Business Insurance You Can Count On

Whether you own a veterinarian, an ice cream shop or a barber shop, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Joel Hensel today, and let's get down to business.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Joel Hensel

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.